If you’re planning to sell a property in 2025, understanding the key trends that may impact your sale strategy is essential. Working closely with your trusted Real Estate Sales Agent, these trends can guide your approach to achieving the best possible outcome.

In this guide, we focus on key Sunshine Coast markets — Buderim, Maroochydore, Alexandra Headlands, and Mooloolaba and if you’re analysing other markets, the same principles can be applied.

When we work with you to develop a marketing strategy for your property, we pay close attention to the following key market trends, to make informed decisions:

1. Listing Volumes (Supply)

Real estate markets are driven by the basic principle of supply and demand, with listing volumes reflecting the supply side of the market.

Recently, we’ve seen listing volumes in our key markets continue to fall into the seasonally lower listing environment over the Christmas and New Year holiday period.

In turn we expect that there will then be a corresponding surge of listings in the new year as seller’s seek to capitalise on the market’s shift back into gear.

Given the prevailing higher interest rate environment, which has been in place since November 2023, when the Reserve Bank of Australia (RBA) set the cash rate at 4.35%, homeowner activity has been curbed somewhat across 2024.

However, as market expectations shift towards a potential reduction in interest rates in 2025, we a gradual increase in listings back toward longer term averages, as sellers and buyers position to take advantage of anticipated changes.

A rise in supply across 2025 should coincide with a more dynamic market, where improved buyer sentiment and greater affordability (discussed below) are expected to drive demand that will outpace this increased supply.

Source: RP Data CoreLogic

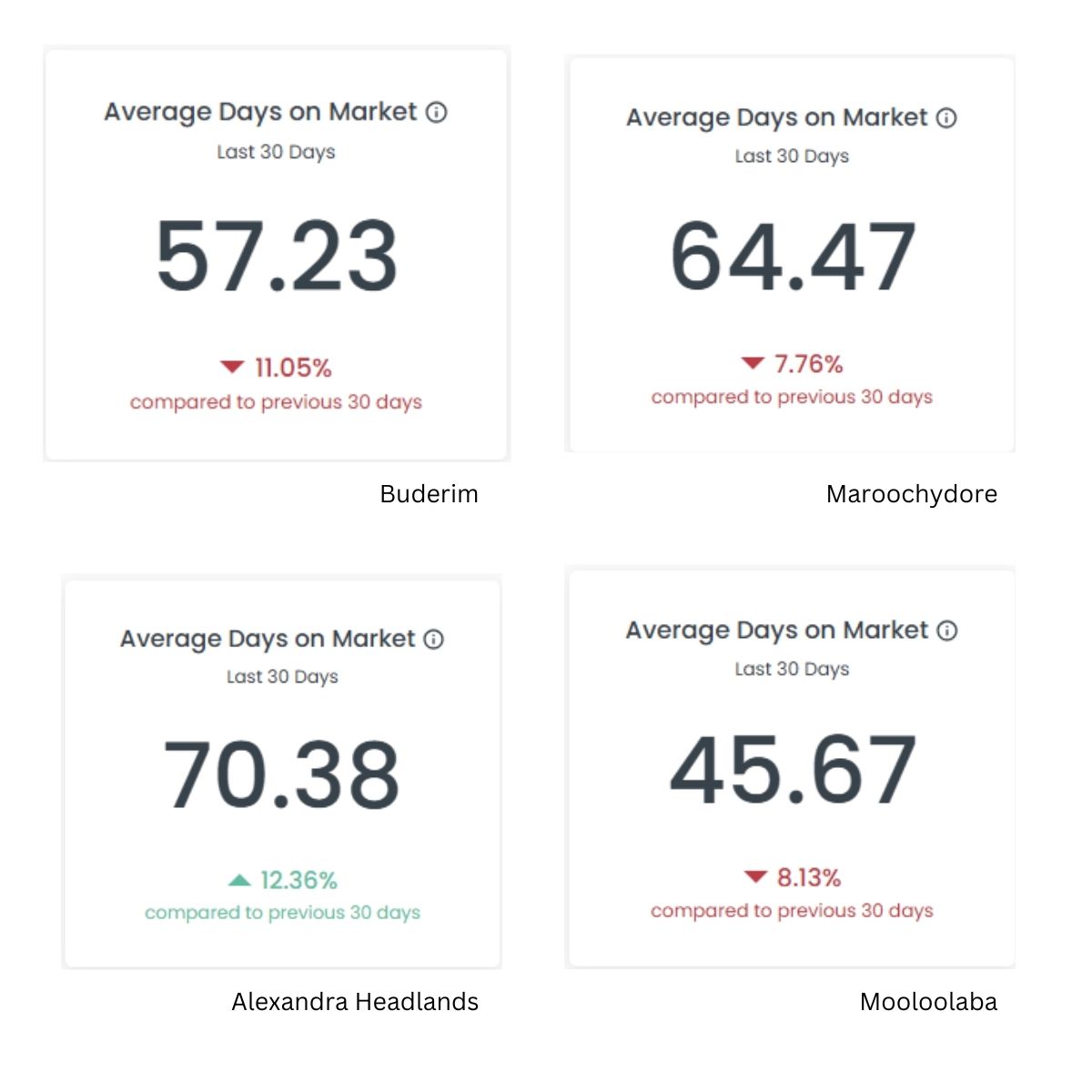

2. Days on Market (Supply/Demand Balance)

Currently, the average days on market in our key Sunshine Coast areas are generally in line with long-term trends, if not slightly above, suggesting a relatively balanced market with some seller and buyer caution.

However, as expectations for lower interest rates in 2025 gain traction, we anticipate that days on market will decrease, consistent with a tighter, faster-moving marketplace.

Days on market is a crucial indicator of supply-demand balance. As listing volumes increase, tracking this data will help assess how quickly new properties are being absorbed.

At Nicholl & Young, we consistently achieve better-than-average days on market times by implementing highly active marketing strategies that maximize property exposure and engagement. This proactive approach is pivotal to our consistent achievement of superior results for our sellers.

Source: RP Data CoreLogic

Another related metrics that may be considered is vendor discounting. We find that this metric is somewhat less instructive as a trend indicator as it can require a more nuanced interpretation of seller “psychology” prevailing in the marketplace.

An example of this is that there a large spread between the bid (buyer) and the ask (seller) for a property, where seller expectations remain high, say due to a prior period of strong market results, but buyer valuations have adjusted more quickly due to a recent macro environmental market shift.

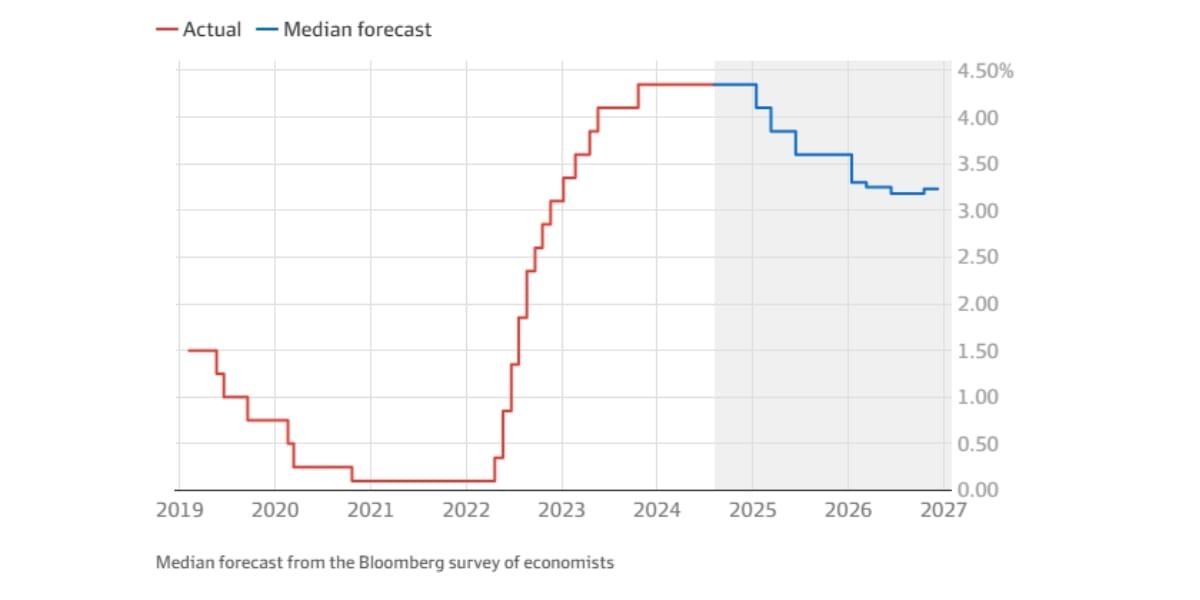

3. Affordability (Demand)

Affordability plays a significant role in the real estate market and is largely influenced by mortgage interest rates, which directly impact buyers' lending capacity.

Currently, the expectation of a decrease in interest rates throughout 2025 is likely to improve affordability and stimulate demand. Although the timing and extent of these rate cuts remain uncertain any downward movement while improve the dynamism of the market and benefit both sellers and buyers.

Median Forecast Interest Rates from Bloomberg Survey of Economists, Aug 2024

Source: Michael Read (AFR), Bloomberg, RBA

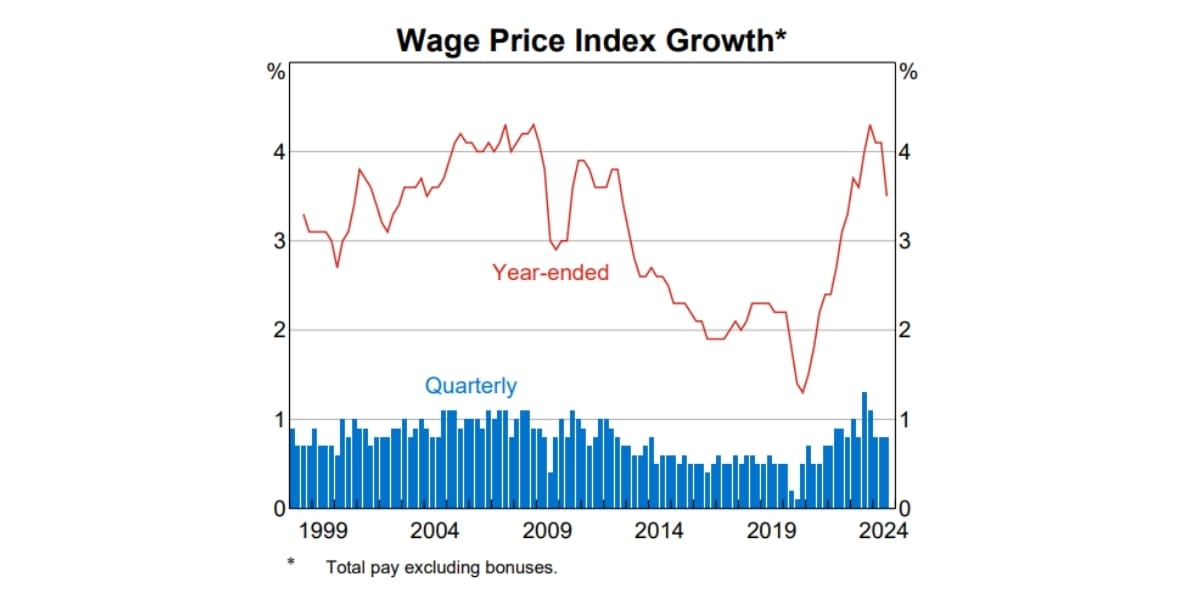

Additionally, wage growth continues to show strong growth relative to the previous 20 year period, further enhancing the buying power of potential buyers, especially over the medium to long term.

Source: ABS, RBA

4. Population Trends (Demand)

Net overseas and interstate migration into Southeast Queensland continues to be strong, outpacing long-term averages with the compelling lifestyle on offer supported by solid prevailing economic conditions. This trend adds positive momentum to the market, contributing to the ongoing stronger underlying demand.

With the 2023 Brisbane Olympics on the horizon and the significant investments associated with this event, migration into Queensland is expected to remain robust, supporting the property market.

Additionally, Southeast Queensland remains relatively more affordable compared to markets like Sydney, inner Melbourne and other key regional NSW and Victorian areas, making it an attractive proposition for buyers.

Source: Australian Bureau of Statistics

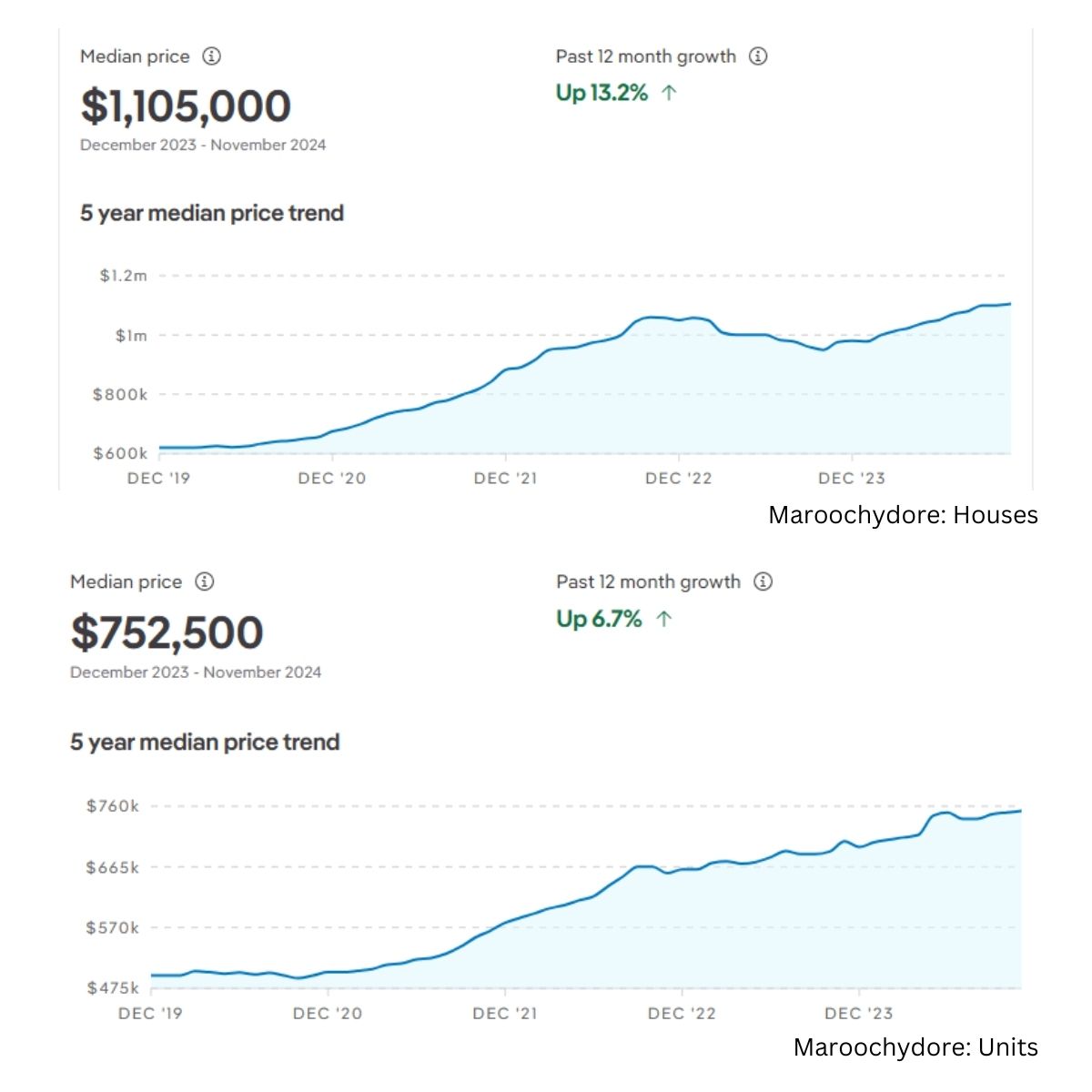

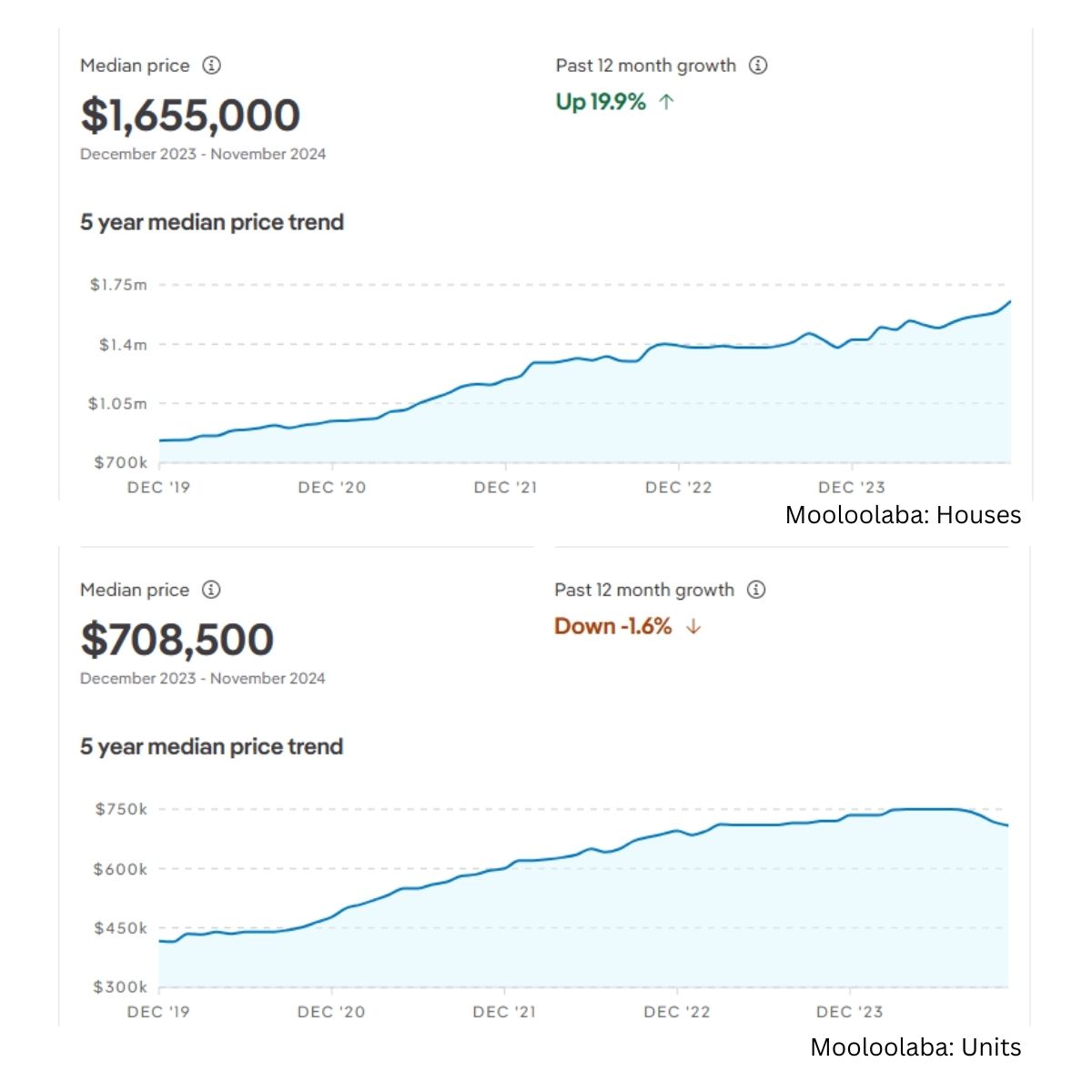

5. Price Trends (Supply/Demand Balance)

Property prices are a key reflection of the supply and demand balance in the market.

Despite potential shifts towards a more balanced market, prices in our key areas have generally remained on an upward trajectory.

This indicates that demand is still outpacing supply, and buyers are continuing to see long-term value in the property market.

Even as factors like affordability and days on market suggest a more balanced environment, buyers are looking beyond the short-term picture and maintaining a positive outlook on the market’s long-term prospects.

Source: REA Group

Source: REA Group

Source: REA Group

Source: REA Group

Conclusion

If you have plans to sell in 2025, or would just like to discuss options, we would love to work with you and share our insights and expertise with the aim of helping you achieve your goals for year ahead.